All Categories

Featured

Table of Contents

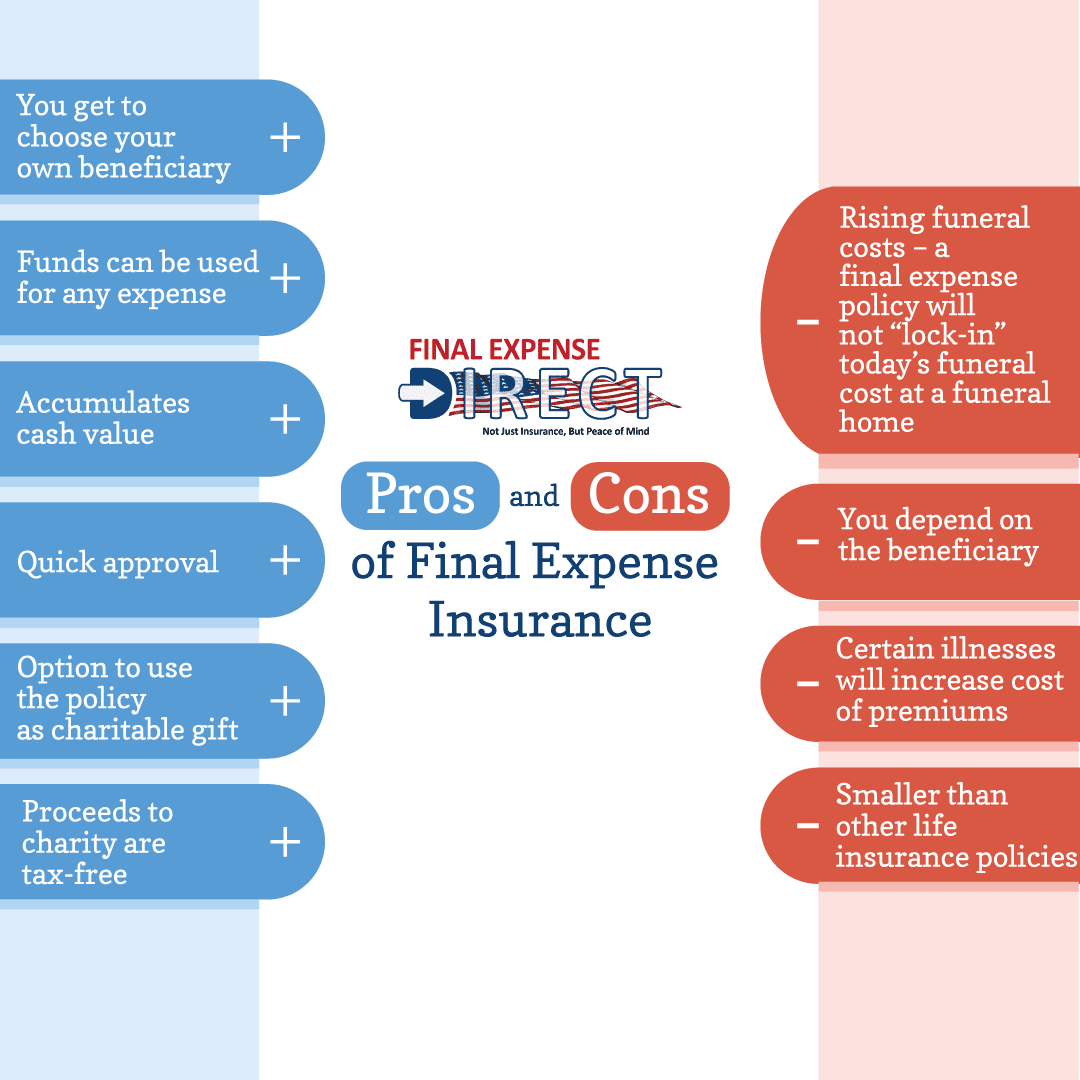

While many life insurance coverage products require a clinical test, final expenditure insurance policy does not. When applying for last cost insurance policy, all you have to do is address numerous questions about your health and wellness.

This implies that a particular amount of time should pass previously benefits are paid. If you're older and not in the ideal health and wellness, you may notice higher costs for last expense insurance policy. You may be able to locate even more inexpensive insurance coverage with one more sort of policy. Prior to you dedicate to a final expenditure insurance policy, consider these aspects: Are you simply looking to cover your funeral and interment expenditures? Do you intend to leave your loved ones with some cash to spend for end-of-life costs? If so, final cost insurance coverage is likely a good fit.

If you would certainly such as enough coverage without breaking the bank, last cost insurance policy may be beneficial. If you're not in great wellness, you may intend to avoid the medical examination to get life insurance policy coverage. In this instance, it might be clever to consider last expense insurance policy. Final expense insurance policy can be a terrific method to help shield your loved ones with a tiny payout upon your death.

What Is A Funeral Policy

Plan becomes exchangeable to an entire life policy between the ages of 22 to 25. A handful of variables affect just how much last cost life insurance coverage you absolutely need.

They can be utilized on anything and are created to assist the beneficiaries prevent an economic crisis when a loved one passes. Funds are usually used to cover funeral prices, clinical expenses, paying off a mortgage, car car loans, or perhaps used as a savings for a new home. If you have adequate financial savings to cover your end-of-life expenditures, then you may not need last cost insurance policy.

On top of that, if you've been unable to qualify for bigger life insurance policy policies as a result of age or medical conditions, a last expense plan may be an inexpensive option that lowers the burden put on your family members when you pass. Yes. Final cost life insurance policy is not the only way to cover your end-of-life expenses.

These generally supply higher insurance coverage quantities and can shield your household's lifestyle along with cover your last costs. Related: Whole life insurance policy for seniors.

They are commonly released to candidates with several health conditions or if the candidate is taking certain prescriptions. If the insured passes throughout this period, the beneficiary will normally receive every one of the costs paid right into the plan plus a tiny extra percentage. Another last expense alternative provided by some life insurance policy business are 10-year or 20-year plans that give candidates the alternative of paying their policy completely within a particular period.

What Type Of Insurance Is Final Expense

One of the most vital thing you can do is address concerns honestly when getting end-of-life insurance. Anything you keep or hide can create your advantage to be denied when your family requires it most. Some individuals assume that since many last expense policies do not require a medical examination they can exist about their wellness and the insurance provider will certainly never ever recognize.

Share your last wishes with them too (what flowers you could want, what passages you want read, tracks you want played, and so on). Documenting these in advance will certainly save your liked ones a great deal of tension and will certainly avoid them from attempting to guess what you desired. Funeral expenses are rising all the time and your health and wellness might change suddenly as you age.

The key recipient gets 100% of the fatality benefit when the insured dies. If the key beneficiary passes prior to the insured, the contingent gets the benefit.

Always alert your life insurance business of any kind of modification of address or phone number so they can update their records. Several states permit you to pre-pay for your funeral.

The fatality benefit is paid to the key recipient once the insurance claim is accepted. It depends on the insurance policy firm.

Burial Insurance Life

If you do any kind of type of funeral preparation ahead of time, you can document your final yearn for your primary recipient and reveal just how much of the plan benefit you intend to go in the direction of final setups. The procedure is generally the exact same at every age. A lot of insurer call for an individual be at the very least 1 month of age to get life insurance policy.

Some business can take weeks or months to pay the policy advantage. Others, like Lincoln Heritage, pay accepted insurance claims in 1 day. It's tough to state what the typical costs will certainly be. Your insurance policy price depends on your health, age, sex, and just how much protection you're taking out. A great quote is anywhere from $40-$60 a month for a $5,000 $10,000 plan.

Cigarette rates are higher no issue what kind of life insurance coverage you take out. Final expenditure insurance coverage raises a monetary problem from families regreting the loss of someone they love.

Last cost insurance coverage has a fatality advantage made to cover costs such as a funeral service or memorial service, embalming and a coffin, or cremation. Beneficiaries can utilize the death benefit for any type of function, from paying home tax obligations to taking a holiday. "They market the final expense insurance coverage to individuals that are older and beginning to consider their funeral costs, and they make it look like they need to do it in order to look after their family members," claims Sabo.

Last cost insurance coverage is a little whole life insurance policy policy that is simple to certify for. The beneficiaries of a final expense life insurance policy policy can use the plan's payout to pay for a funeral solution, casket or cremation, clinical expenses, nursing home bills, an obituary, blossoms, and a lot more. Nonetheless, the death advantage can be used for any type of objective whatsoever.

When you get last expense insurance coverage, you will not need to handle a clinical examination or allow the insurance provider gain access to your clinical records. However, you will certainly need to respond to some wellness inquiries. As a result of the health inquiries, not every person will certainly get approved for a policy with coverage that begins on the first day.

Funeral Underwriters

The older and much less healthy and balanced you are, the greater your prices will certainly be for a provided amount of insurance coverage. Male tend to pay higher prices than ladies as a result of their shorter ordinary life expectations. And, depending upon the insurance firm, you might certify for a reduced rate if you do not make use of tobacco.

Nevertheless, relying on the policy and the insurance firm, there might be a minimal age (such as 45) and optimum age (such as 85) at which you can apply. The largest death benefit you can select might be smaller sized the older you are. Policies may go up to $50,000 as long as you're younger than 55 yet only increase to $25,000 once you transform 76.

Let's claim you're retired, no longer live insurance policy via your employer, and do not have a private life insurance policy. Neither do you have a savings big sufficient to reduce the monetary worry on your partner and/or youngsters when you pass away. You're thinking about a brand-new life insurance policy. You call a life insurance policy agent and start the application procedure.

Latest Posts

Burial Insurance For Seniors Over 70

National Burial Insurance Company

Life Expense Coverage