All Categories

Featured

Table of Contents

Life insurance is more than just a policy; it’s a vital tool for protecting your loved ones and securing their financial future. Whether you’re looking for term life insurance to cover immediate needs or whole life insurance for lifelong security, the right policy offers peace of mind during life’s uncertainties. life insurance for families through brokers. Affordable options include universal life insurance, which combines flexibility with investment opportunities, or final expense insurance, designed to cover funeral costs and related expenses

For homeowners, mortgage protection life insurance provides added security, ensuring your family can keep their home in case of unexpected events. Accidental death insurance is another valuable option, offering coverage tailored to specific circumstances. Many policies now come with living benefits, allowing policyholders to access funds in cases of critical illness or other emergencies, adding another layer of financial support.

Life insurance adapts to your goals, whether you’re planning for retirement, saving for college, or ensuring your business is protected with key person insurance. Speak with a licensed insurance agent today to discover flexible options that align with your family or business needs. Request a free quote now and take the first step toward a secure tomorrow.

It permits you to spending plan and prepare for the future. You can easily factor your life insurance coverage into your spending plan since the costs never change. You can prepare for the future just as quickly due to the fact that you know exactly just how much cash your liked ones will get in case of your absence.

This holds true for people that quit smoking cigarettes or that have a wellness problem that settles. In these situations, you'll usually have to go through a new application procedure to get a much better rate. If you still need protection by the time your degree term life plan nears the expiration day, you have a few options.

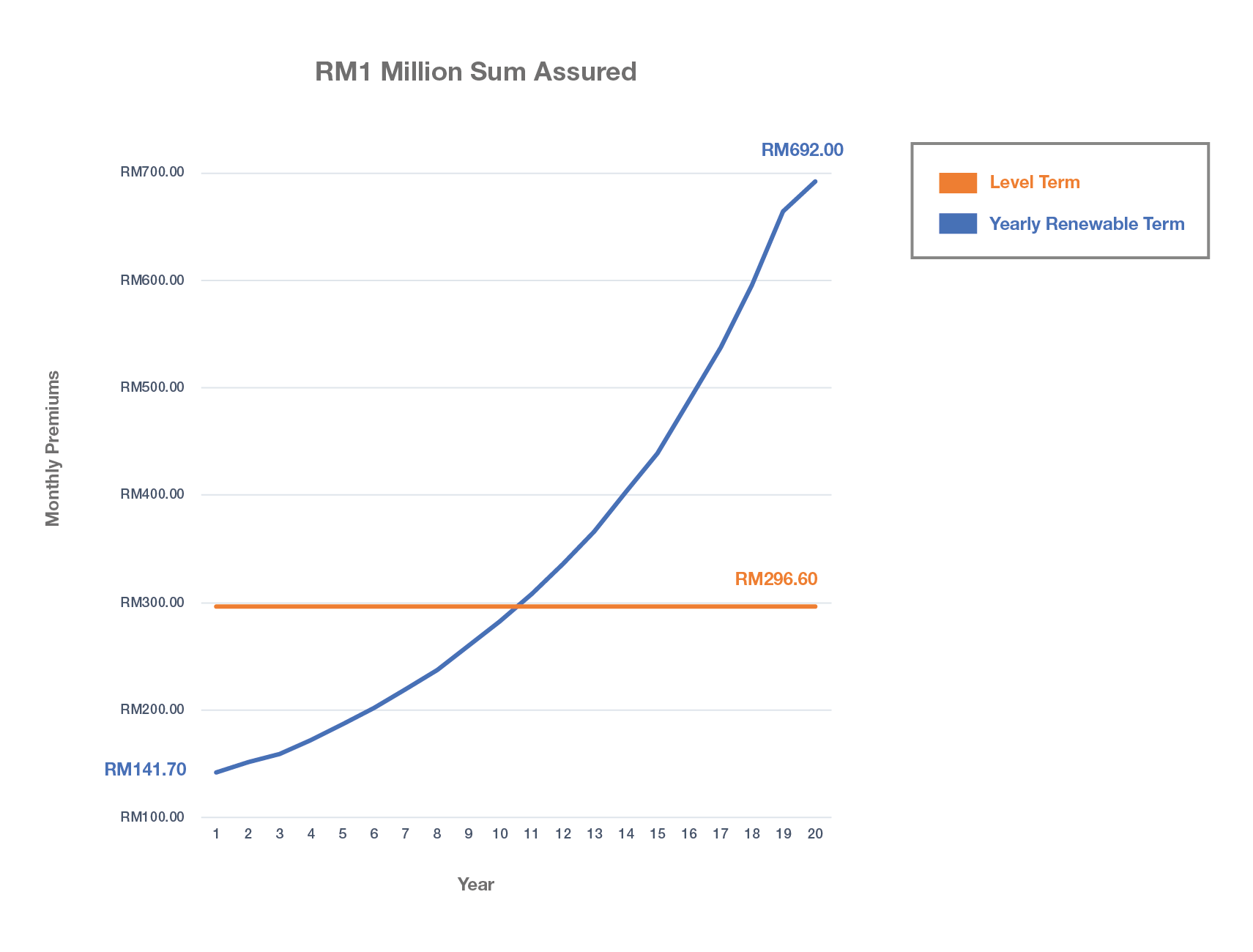

Most degree term life insurance policy policies feature the choice to restore coverage on a yearly basis after the initial term ends. direct term life insurance meaning. The cost of your plan will certainly be based on your present age and it'll enhance yearly. This could be a great choice if you only require to expand your protection for a couple of years or else, it can obtain costly pretty rapidly

Level term life insurance policy is among the most affordable coverage options on the marketplace because it supplies standard defense in the type of survivor benefit and just lasts for a collection time period. At the end of the term, it runs out. Entire life insurance coverage, on the other hand, is dramatically extra expensive than degree term life due to the fact that it doesn't run out and includes a cash value attribute.

Cost-Effective What Is Voluntary Term Life Insurance

Rates may differ by insurer, term, insurance coverage quantity, health and wellness class, and state. Not all policies are available in all states. Rate picture legitimate since 10/01/2024. Level term is a terrific life insurance policy alternative for many people, yet depending on your coverage requirements and individual situation, it could not be the very best fit for you.

This can be a great alternative if you, for instance, have just give up smoking and require to wait 2 or 3 years to use for a level term policy and be eligible for a lower rate.

Guaranteed Increasing Term Life Insurance

With a decreasing term life policy, your survivor benefit payment will reduce in time, however your repayments will stay the same. Decreasing term life plans like home mortgage security insurance typically pay to your lender, so if you're seeking a plan that will certainly pay to your loved ones, this is not an excellent suitable for you.

Raising term life insurance policies can assist you hedge versus inflation or strategy economically for future kids. On the other hand, you'll pay more upfront for much less insurance coverage with a raising term life plan than with a level term life policy. If you're unsure which sort of plan is best for you, dealing with an independent broker can aid.

As soon as you've chosen that degree term is best for you, the next step is to purchase your policy. Right here's just how to do it. Calculate exactly how much life insurance coverage you need Your protection amount must attend to your family members's lasting financial demands, including the loss of your earnings in the event of your fatality, as well as debts and day-to-day expenditures.

A level premium term life insurance coverage plan lets you stick to your budget plan while you help secure your family members. ___ Aon Insurance Providers is the brand name for the brokerage and program management operations of Affinity Insurance Services, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Affinity Insurance Policy Company, Inc. (CA 0795465); in Alright, AIS Fondness Insurance Coverage Services Inc.; in CA, Aon Affinity Insurance Services, Inc.

The Strategy Agent of the AICPA Insurance Count On, Aon Insurance Policy Providers, is not associated with Prudential.

Latest Posts

Burial Insurance For Seniors Over 70

National Burial Insurance Company

Life Expense Coverage